Insurance Broker License

12 April 2023 2023-04-14 10:59Insurance Broker License

Public Limited

Company Registration

Incorporating a Public Company will provide you security & enjoys far more credibility than other business forms. Count on Corpbiz, and allow us to assist you in Registering Public Limited Company..

100000 +

Happy Customer

1000 +

CA & Lawyers

50 +

Offices

Rated at 4.9 By 50000 + Customers Globally

Step 1

Step 2

Step 3

Overview

Overview of Public Limited Company Registration

Public limited companies enjoy all the rights of a corporate entity with limited liabilities and it is an ideal choice for the small and medium scale enterprises who wish to raise the equity capital from the general public.

Basic Clarification on Incorporation of Public Limited Company

Just like other companies, Public Limited Company is also registered as per the rules and regulations of the Companies Act, 2013. A public Company enjoys the benefits of limited liabilities for its members and has rights to sell its shares for raising the capital of the company. It can be incorporated with a minimum number of three directors and has more stringent rules and regulations as compared to a Pvt. Ltd. Company.

It must have a minimum number of seven members whereas there is no limit for the maximum number of members. It provides all the benefits of a private limited company along with more transparency and easy transferability of ownership and shareholding. Name, shares, formation, number of members, management and directors, etc differentiates any Public limited company from the private limited companies.

Financial Requirements

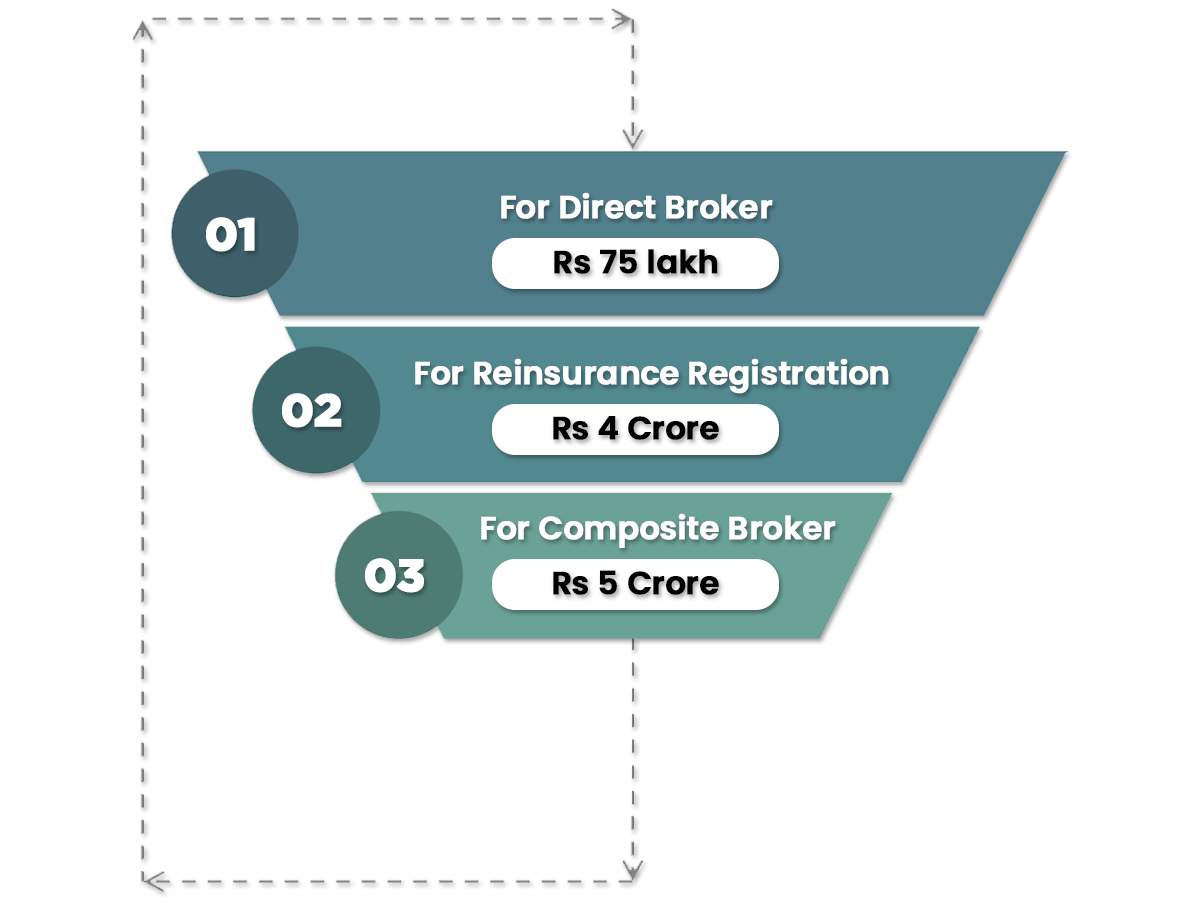

Minimum Financial Requirements for Insurance Broker License

An applicant with the following minimum capital requirement can apply for the insurance broker registration:

- For Direct Broker- Rs 75 lakh

- For Reinsurance Registration- Rs 4 Crore

- For Composite Broker- Rs 5 Crore

Net Worth Requirement

During the process of registration of Insurance Broker License it is necessary for Insurance Broker to maintain the minimum net worth of

- For Direct Broker- Rs 50 Lakh

- For reinsurance and composite Broker- 50% of the minimum capital requirement

Deposit Requirement

It is necessary for the applicant to deposit the certain amount with the scheduled bank. Make sure to deposit the amount before applying for the application of registration and during the course of Insurance Broker License.

- Direct Broker- Rs 10 Lakh

- Reinsurance and Composite Broker- 10% of the minimum capital requirement

Functions

Functions of Insurance Broker License

Functions of a Direct Broker

- Acquiring complete information related to business and risk management strategy of the client;

- Getting familiar with the client’s business nature and underwriting information which will further help you in explaining business related things to insurer and others;

- Giving suggestion related to suitable insurance cover and terms;

- Having complete knowledge about the available insurance markets;

- Insurer provides the quotation regarding the consideration of client.

Functions of a Re-Insurance Broker

- Familiarizing with the client’s business nature and risk retention strategy;

- Maintaining clear and healthy records of the insurer’s business;

- Giving advice on the matters pertaining to insurance covers and different kinds of insurance covers available in the international insurance and reinsurance markets;

- Creating database of available reinsurance markets which also covers solvency ratings of individual reinsurers;

- To protect reinsurance, delivering risk management services;

- Proposing a reinsurer or a group of reinsurer;

- Doing negotiations with a reinsurer on the client’s behalf;

Functions of a Composite Broker

Composite broker conducts all the functions performed by Direct Broker and Re-insurance broker.

Registration Procedure

Public Limited Company Registration Procedure

Step 1: Apply for the Digital Signature Certificate

First of all, you have to apply for the Digital Signature Certificate for all the proposed directors in the company. DSC is used to sign the e-forms and is an authentic and safe method to file all the documents on an electronic platform. It is a mandatory document.

A director can easily obtain DSC from the nearest Certifying Authorities or CAs with self-attested coppices of their identity proof. It takes around 1 -3 working days to obtain a DSC.

Step 2: Name Verification

The third step involves name registration of the company. You can check the name availability through the MCA portal by following this step

Visit the MCA Portal> select the MCA services> Click Check Company Name

Note: The company name should not be taken or registered and should not be similar to a brand name.

Step 3: Filing Form SPICe+

Once the company’s name has been approved you can now file the SPICe+ form to avail the company incorporation certificate. Along with it, you have to file all the required documents such as MOA (Memorandum of Association) and AOA (Article of Association). These two documents contain the details of the mission, objectives, aims, visions, business activities, responsibilities of all the directors and shareholders and definition of the proposed company.

All the documents and applications are further verified by the higher authorities and it takes around 7 to 9 working days.

Step 4: Obtaining Certificate of Incorporation

Once all the applications and document to have been received to the authorities and they have verified it, the company would receive the Certificate of Incorporation which will include CIN and date of incorporation.

Requirements for the Public Company Registration

According to the provisions of Companies Act, 2013 here are the requirements you need to fulfill to incorporate a Public company in India:

- The proposed company must have a minimum number of 7 shareholders

- The proposed company must have a minimum number of 3 directors

- No minimum capital required

- At least one director should have a Digital Signature Certificate

- Memorandum of Association and Article of Association.

- After approval from Registrar of the Companies, the proposed public company has to apply for the “Certificate of Business Commencement.”

Fees

Non-refundable Application Fees

- For Direct Broker – Rs. 25,000

- For Reinsurance Broker – Rs. 50,000

- For Composite Broker – Rs. 75,000

Registration Fees for Fresh Registration

- For Direct Broker – Rs. 50,000

- For Reinsurance Broker – Rs. 1,50,000

- For Composite Broker – Rs. 2,50,000

Renewal Fees for a period of 3 years

- For Direct Broker – Rs. 1,00,000

- For Reinsurance Broker – Rs. 3,00,000

- For Composite Broker – Rs. 5,00,000

Why Corpbiz

(We make technical compliance certifications effortless and convenient.)

4.9+

100,000+

1000+ Team

Among 1% of

Get started?

We also help you market your products through an online marketplace.

Fill up Application Form

Make Online Payment

Executive will Process

Get Confirmation Mail